CenterPoint Accounting

- Amortization Schedule

| Document #: | 3183 | Product: | CenterPoint® |

|---|

An amortization schedule is commonly used in mortgages and installment loans, showing the number of payments due, the amount due in each installment, the declining principal balance, and the number of years needed to fully extinguish the debt. The amortization schedule in CenterPoint can also help you analyze "what if" scenarios in regards to your loans. For example, what will the savings be if I make extra principal payments? Or which scenario makes better financial sense for the business; a short term loan with higher payments and lower APR or a long term loan with lower payments and higher APR?

Create an Amortization Schedule

- On the Reporting Tools menu, select Amortization Schedule.

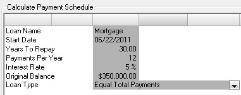

- In the Loan Name box, enter the name that you want printed at the top of the Loan Payment Schedule report.

- Enter the Start Date, Years to Repay, Payments Per Year, Interest Rate, and Original Balance of the loan.

- In the Loan Type box, select either Equal Principal Payments (the amount of principal paid stays the same but the total payment amount varies depending on the amount of interest and the loan balance) or Equal Total Payments (the total payment is the same each time but the proportion of principal and interest varies with the beginning payments mostly interest). Most loans are calculated using the Equal Total Payments option.

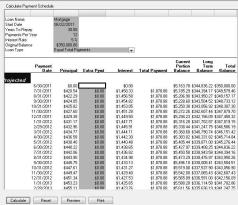

- Click Calculate and the amortization schedule will be displayed on the screen.

- To preview a copy formatted for printing, click Preview or to print the Loan Payment Schedule report, click Print. On the Print screen select your printing properties,and then click Print.

- To clear the current amortization schedule and start a new amortization schedule, click Reset.

- Click Close to exit the screen.

Calculate the Cost Savings from Making Additional Principal Payments

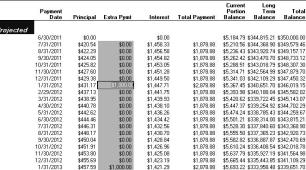

In our example, we are going to calculate the amount saved by making a $1000 additional principal payment the first month of each year, for the first 10 years of a 30 year loan.

- Follow the steps above to create an amortization schedule using the original terms of the loan.

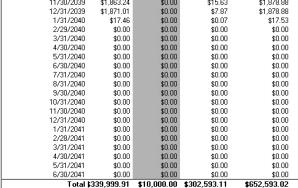

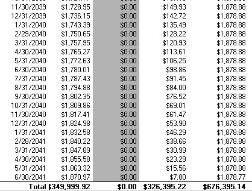

- Print the Loan Payment Schedule or scroll down and note the amount in the Total field in the Total Payments column.

- Enter the extra payments directly into the Extra Pymt column. In our case we entered $1000 in the first month of each year, for the first 10 years of the loan.

- Once the extra payments are entered, either reprint the Loan Payment Schedule or scroll down and compare the new amount in the Total field in the Total Payments column to the original. Also note the number of payments that were eliminated by making additional payments (these will be at the end of the loan and the amounts will be zero). In this case, by paying an extra $10,000 in payments early on in the loan, they would save over $25,000 in the life of the loan (and decrease their payment schedule by 17 payments!)